Retiring Soon?

Get Help Your Way

(844) 410-1322

Medicare Costs Explained

Medicare covers a wide range of medical services. But Medicare is not free – it does not cover everything.

Anyone with Medicare will pay for a portion of their expenses, but what you pay will depend on the type of coverage that you have – Parts A & B (Original Medicare), Part C (a private Medicare Advantage plan), a Part D prescription drug plan and/or Medigap (supplemental coverage). What you pay will also depend on where you receive services and if you have other forms of insurance.

Medicare Parts

Part A

You usually don’t pay a monthly premium for Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes while working. This is sometimes called “premium-free Part A.”

If you buy Part A, you’ll pay up to $411 each month.

But, most people get premium-free Part A. You can get premium-free Part A at 65 if:

You already get retirement benefits from Social Security or the Railroad Retirement Board.

You’re eligible to get Social Security or Railroad benefits but haven’t filed for them yet.

You or your spouse had Medicare-covered government employment.

If you’re under 65, you can get premium-free Part A if:

You got Social Security or Railroad Retirement Board disability benefits for 24 months.

You have End-Stage Renal Disease (ESRD) and meet certain requirements.

In most cases, if you choose to buy Part A, you must also have Medicare Part B (Medical Insurance) and pay monthly premiums for both.

Part C

Your out-of-pocket costs in a Medicare Advantage Plan (Part C) depend on:

Whether the plan charges a monthly premium.

Whether the plan pays any of your monthly Medicare Part B (Medical Insurance) premium.

Whether the plan has a yearly deductible or any additional deductibles.

How much you pay for each visit or service (copayment or coinsurance). For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those under Original Medicare.

The type of health care services you need and how often you get them.

Whether you go to a doctor or supplier who accepts assignment (if you’re in a PPO, PFFS, or MSA plan and you go out-of-network).

Whether you follow the plan’s rules, like using network providers.

Whether you need extra benefits and if the plan charges for it.

The plan’s yearly limit on your out-of-pocket costs for all medical services.

Whether you have Medicaid or get help from your state.

Part B

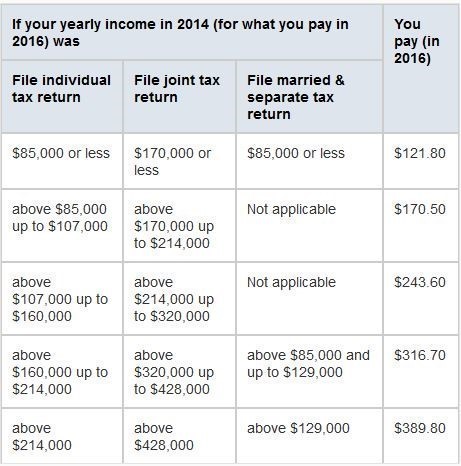

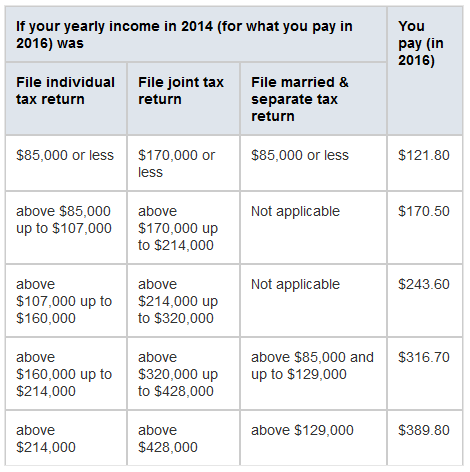

You pay a premium each month for Part B.

If you get Social Security, Railroad Retirement Board, or Office of Personnel Management benefits, your Part B premium will be automatically deducted from your benefit payment.

If you don’t get these benefit payments, you’ll get a bill.

Most people will pay the standard premium amount.

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA).

IRMAA is an extra charge added to your premium.

The standard Part B premium amount is $121.80 (or higher depending on your income).

However, most people who get Social Security benefits will continue to pay the same Part B premium amount as they paid in 2015.

This is because there wasn’t a cost-of-living increase for 2016 Social Security benefits.

You’ll pay a different premium amount if:

You enroll in Part B for the first time in 2016.

You don’t get Social Security benefits.

You’re directly billed for your Part B premiums.

You have Medicare and Medicaid, and Medicaid pays your premiums. (Your state will pay the standard premium amount of $121.80.)

Your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount.

If you’re in 1 of these 5 groups, here’s what you’ll pay:

Part B deductible & coinsurance

You pay $166 per year for your Part B deductible. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment.

Part D

You’ll make these payments throughout the year in a Medicare drug plan:

Premium

Most Medicare Prescription Drug Plans charge a monthly fee that varies by plan. You pay this in addition to the Medicare Part B premium. If you belong to a Medicare Advantage Plan (Part C) or a Medicare Cost Plan that includes Medicare prescription drug coverage, the monthly premium you pay to your plan may include an amount for drug coverage.

Get your premium automatically deducted

Contact your drug plan (not Social Security) if you want your premium deducted from your monthly Social Security payment. Your first deduction will usually take 3 months to start, and 3 months of premiums will likely be deducted at once.

After that, only one premium will be deducted each month. You may also see a delay in premiums being withheld if you switch plans. If you want to stop premium deductions and get billed directly, contact your drug plan.

How much does Part D cost?

Most people only pay their Part D premium. If you don’t sign up for Part D when you’re first eligible, you may have to pay a Part D late enrollment penalty.

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain limit, you may pay a Part D income-related monthly adjustment amount (Part D-IRMAA) in addition to your monthly plan premium. This extra amount is paid directly to Medicare, not to your plan.

Yearly deductible

This is the amount you must pay each year for your prescriptions before your Medicare Prescription Drug Plan begins to pay its share of your covered drugs.

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $360 in 2016. Some Medicare drug plans don’t have a deductible.

Copayments or coinsurance

The amount you pay for each of your prescriptions after you have paid the deductible (if your plan has one) is either a copayment or coinsurance. Some Medicare Prescription Drug Plans have different levels or ” tiers ” of copayments or coinsurance, with different costs for different types of drugs.

With a copayment, you pay a set amount (like, $10) for all drugs on a tier. For example, you may pay a lower copayment for generic drugs than brand-name drugs.

Coinsurance means you pay a percentage of the cost (like, 25%) of the drug.

Usually, the amount you pay for a covered prescription is for a one-month supply of a drug. However, you can request less than a one-month supply for most types of drugs. You might do this if you’re trying a new medication that’s known to have significant side effects or you want to synchronize the refills for all your medications. If you do this, the amount you pay is reduced based on the quantity you actually get. Talk with your prescriber to get a prescription for less than a one-month supply.

Costs in the coverage gap

Brand-name prescription drugs

Once you reach the coverage gap in 2016, you’ll pay 45% of the plan’s cost for covered brand-name prescription drugs. You get these savings if you buy your prescriptions at a pharmacy or order them through the mail. The discount will come off of the price that your plans has set with the pharmacy for that specific drug.

Although you’ll only pay 45% of the price for the brand-name drug in 2016, 95% of the price—what you pay plus the 50% manufacturer discount payment—will count as out-of-pocket costs which will help you get out of the coverage gap. What the drug plan pays toward the drug cost (5% of the price) and what the drug plan pays toward the dispensing fee (55% of the fee) aren’t counted toward your out-of-pocket spending.

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan’s coverage has been applied to the price of the drug. The discount for brand-name drugs will apply to the remaining amount that you owe.

Generic drugs

In 2016, Medicare will pay 42% of the price for generic drugs during the coverage gap. You’ll pay the remaining 58% of the price. What you pay for generic drugs during the coverage gap will decrease each year until it reaches 25% in 2020. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan’s coverage has been applied to the price of the drug.

Items that count towards the coverage gap

Your yearly deductible, coinsurance, and copayments

The discount you get on brand-name drugs in the coverage gap

What you pay in the coverage gap

Items that don’t count towards the coverage gap

The drug plan premium

Pharmacy dispensing fee

What you pay for drugs that aren’t covered

If you think you should get a discount

If you think you’ve reached the coverage gap and you don’t get a discount when you pay for your brand-name prescription, review your next “Explanation of Benefits” (EOB). If the discount doesn’t appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date. Get your plan’s contact information from a Personalized Search (under General Search), or search by plan name. If your drug plan doesn’t agree that you’re owed a discount, you can file an appeal.

” OUR JOB IS TO HELP YOU LIMIT FINANCIAL RISK “